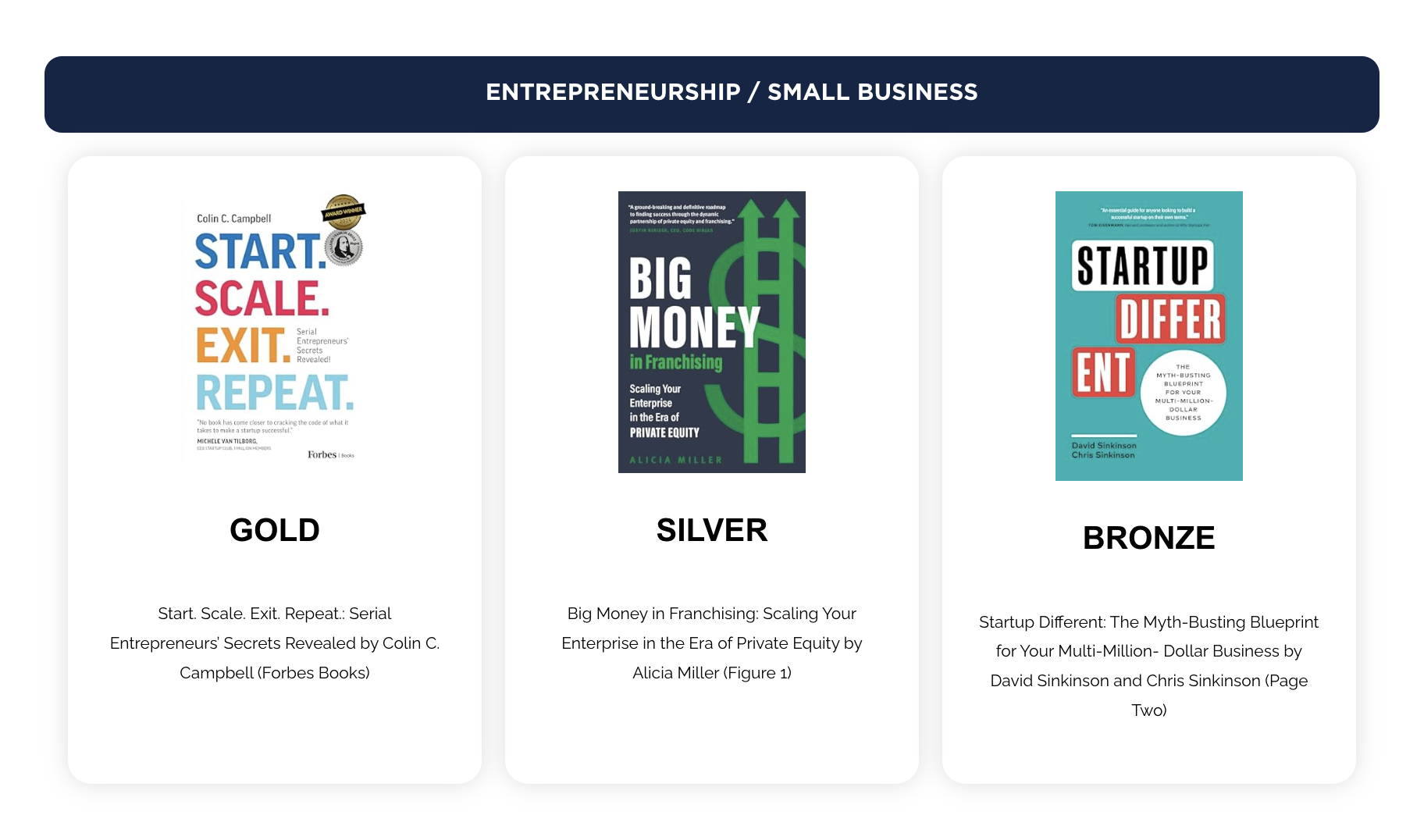

Every great business starts with a story—and this year’s Axiom Business Book Award winners in the Entrepreneurship & Small Business category have shared some of the best. Colin C. Campbell’s Start. Scale. Exit. Repeat. earned the 2025 Axiom Gold Award, alongside runners-up Big Money in Franchising: Scaling Your Enterprise in the Era of Private Equity by Alicia Miller, and Startup Different: The Myth-Busting Blueprint for Your Multi-Million-Dollar Business by David Sinkinson and Chris Sinkinson. These authors turned their real-world experience into powerful, practical books that inspire and guide entrepreneurs at every stage. We caught up with them to learn more about what motivated them to write, the lessons they’ve learned, and the advice they’d pass along to fellow founders.

1. What inspired you to take the time to turn your entrepreneurial experiences into a book, and what story or lesson did you feel most compelled to share?

Colin C. Campbell: Quite frankly after 30 years as a serial entrepreneur with a string of failures and successes, it motivated me to share the formula of what works and what doesn’t so it can help others be successful in their startup journey.

Alicia Miller: I saw a huge gap in understanding and felt the topic of private equity in franchising was so important it needed a detailed study. PE often doesn’t disclose its methods, valuations paid, and so on. It makes it more difficult especially for founders and franchisees to choose their optimal path. But the playbook is actually very straightforward and predictable. Valuation information and PE’s track record are available if you know where to look.

I wrote Big Money in Franchising to break all this complexity into a straightforward guide and series of pragmatic actions depending on readers’ unique objectives. It was primarily written for franchise founders and franchisees, but also for investors new to franchising. Franchise stakeholders will also benefit from understanding these market dynamics.

Chris & David Sinkinson: We were looking for a way to “pay it forward” to our entrepreneurial peers. We were fortunate enough to have a successful outcome and wanted the same for others. To that end, we put together a book that chronologically detailed the experience of our company including our biggest wins and losses. We also wanted to check the conventional wisdom – what we call “startup myths” – that often do more harm than good. Hopefully others can learn from us and help reach their business dreams.

2. Looking back, was there a piece of advice or unexpected lesson you uncovered while writing that you wish you had known earlier in your entrepreneurial journey?

Colin C. Campbell: Bad things do happen, so it is a good idea to Start. Scale. Exit. Repeat vs. Start. Scale. Fail. Repeat.

Alicia Miller: When I was a multi-unit franchisee, I wish I had understood the impact of PE on franchise unit resales. PE is a buyer in some scale systems, not in others, and they pretty much avoid sub-scale systems altogether. All that activity, or lack of it, impacts exit multiples. At the time, I assumed I would simply exit to another franchisee when the time was right. Now I would prioritize investing in systems with more buyer activity and thus more deal competition…or systems with all the right signals to suggest it would eventually get there during my ownership period.

Franchise entrepreneurs also should understand PE re-trading, profit-seeking behaviors, and their track record in franchising before investing.

Chris & David Sinkinson: Absolutely. In a way, we wrote the book with this question in mind: what would we have wanted to know 10 years ago that we didn’t know then? There are a lot of surprising revelations – I think though that the biggest one for us was that you need to live up to societal expectations of what a startup “ought” to be if you want to be successful. Later in our business’ life we’d often use the conventional wisdom as a guide on what not to do.

3. If readers were to walk away with just one actionable idea or mindset shift from your book, what would you want that to be?

Colin C. Campbell: Entrepreneurship is a trade like any other trade, and the key to success is mastering that trade.

Alicia Miller: Don’t put up with information gatekeepers. Push to educate yourself and get the performance data you need before investing in, or launching, any franchise business. PE firms have a due diligence playbook that you can mirror to either make good acquisition choices yourself, or anticipate what these professional buyers will be looking for if you’re thinking about exit strategies. Using the professional buyer lens on your business is a terrific tool to think differently about your enterprise value creation strategy. It helps you get outside of yourself a bit to look objectively at the business and make smarter decisions.

Chris & David Sinkinson: Don’t look for validation in society or among your peers. Look for validation in the market. Drive to early profit and ignore the haters.